How Khatabook became the premier fintech app powering Bharat's small and medium business owners

With ~1 million daily active users, 2.5 million downloads, a $300 MM valuation and an uncanny ability to fight and come back stronger - Khatabook has become the leading utility app for Bharat.

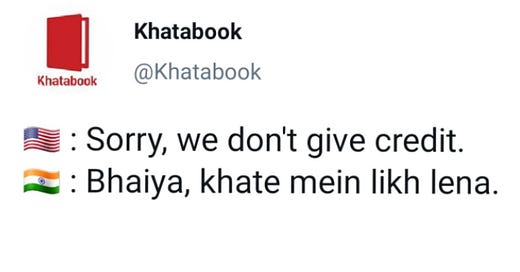

The above two images quite succinctly put into perspective what Khatabook is, its target market, and most importantly: how it has perfected a product and tailored it to suit the market superbly, with an amalgamation of luck, a great idea, a stellar team, and an understanding of its target user base virtually rivaled by none.

This is the story of Khatabook, one of the fastest-growing startups in India today, how it made inroads into an India that was slowly but steadily undergoing an unprecedented digital transformation and became quite possibly the foremost utility app used by small businesses and MSMEs in India today.

The product and problem addressed:

To understand why Khatabook has been so successful, we first need to understand what Khatabook is.

In my opinion, Khatabook is like Tally on steroids - the good ones - wherein the aim is to digitize poorly accounted for credit and make it easier for both businesses and customers to track the status of what they have lent and what they owe in an easy-to-use, seamless manner.

Indian small businesses and retail shops have long had the culture of giving out credit to customers based on mutual trust between the lenders and borrowers - a significant tradition in a culture otherwise plagued with trust issues. This credit was usually accounted for in the form of a paper ledger or "bahi khata (बही-खाता)," which generally comprised of a small register recording day to day transactions, which more often than not led to poor credit collection, which was bound to happen as the register would only take into account the transactions, and would not follow up with them, along with a host of other issues such as non-transportability.

Khatabook aims to tackle this exact problem - take the traditional बही-खाता online (make it a digital ledger of sorts), couple it with the power of technology and add features such as

free SMS/Whatsapp updates about transactions and their automatic online backup (a major feature lacking in the perishable physical registers)

editing/deleting old transactions, preparing customer PDF reports about their udhaar

setting reminder dates for customers to pay their bills

managing multiple shops within one account, and

accessing the same account through multiple devices

All with a simple UI/UX.

This is what I meant by "Khatabook is like Tally on steroids" - it removes the blandness and requirement of technical know-how of how to manage accounts, which Tally mandates, and instead replaces it with an incredibly easy to use interface with many more features, like the ones mentioned above.

The idea :

As they say, "necessity is the mother of all invention."

Khatabook was no exception.

The idea first came into being when Vaibhav Kalpe, a twenty-something graduate in Nanded, saw his shopkeeper father struggling to keep up with all the credit and receivables he was due by customers.

The year was 2016, and India was beginning to get digitized massively with the advent of Reliance Jio - which, with its low data rates, was enabling the creation of millions of first-time internet users.

Vaibhav, sensing an opportunity in this, decided to do something about it. He equipped himself with the necessary technical know-how of developing an Android app and consequently rolled out the first, crude version of what was to become the fintech behemoth called Khatabook.

Around the same time, in late 2018, Ravish Naresh, fresh out of the end of a roller-coaster journey called Housing.com, which he founded with 12 of his other collegemates from IIT Bombay, was looking for a good utility product that would serve the needs of tier 2 and tier 3 first-time internet users and chanced upon Kalpe's version of Khatabook, which at the time had about 60,000 downloads on Play Store. Thoroughly impressed by what he saw, Naresh contacted Kalpe, and soon, they joined hands to take Khatabook to the next level.

By this time, India's Jiofication was complete, and most of tier 2 and tier 3 India was now on the internet. Naresh and Kalpe, along with a superb team, now fully revamped Khatabook to make it as simple for the users as possible. After it was relaunched in December 2018, it exploded. With its many functionalities, the simple-to-use app quickly gained traction through the quintessentially Indian method of word-of-mouth publicity, and soon Khatabook pulled in ~$ 3 billion of transactions in just six months. However, the challenge was beginning.

The ebbs and flows:

Competition is necessary, even essential, for survival because it pushes you to do things you earlier thought weren't possible.

As Khatabook exploded, other competitors were also quick to pounce on the opportunity of catering to a large portion of the Indian small business and MSME community. OkCredit saw phenomenal growth, having raised $84 million, while IndiaMart-backed Vyapar monetized its platform early and plunged deeper into ledger management, and hence saw less growth. In late 2019, Instamojo joined the party, soon followed by Paytm.

This meant that even though the market volume expanded, so did the competition. Also, the problem of monetization was beginning to surface.

Monetization would be necessary at some point in time to rope in more investors. Since most merchants do not value technology over labor, Khatabook had to find an alternative source of income indirectly from the users.

Sitting on a potential gold mine of users requiring financial assistance services such as inventory management, billing, invoice, and GST calculation, Khatabook could potentially use this as a major monetization stream. However, a storm was brewing.

In March 2020, the coronavirus pandemic hit India. Naturally, due to the lockdown, the core user base of Khatabook was severely affected. The number of daily active users went down by 50%, with March and April being a complete bloodbath.

However, powered by a $60 million funding round in May and the country slowly opening up in June, Khatabook recovered well, coming back to ~90% of pre-pandemic levels. However, monetization still plagued the team, and the legal battle with Dukaan over plagiarism, which ensued in August, added to the team's woes. As always, the company came out stronger than before. It settled the case with Dukaan out-of-court, acquiring a stake in its parent company, and came up with potentially new monetization methods, which are very promising if implemented.

One way is obviously, to monetize payment streams, as others such as Amazon, Google, etc., have done. However, as the segment in which Khatabook operates is largely cash-run, there is not a significant amount of transactions done digitally through which commissions can be obtained.

The other, more plausible way would be to create a supply chain network, as it has already been done with MyStore (formerly Dukaan by Khatabook). The company is sitting on a ton of user data, which can be used to drive supply chains in the form of, say, a Swiggy or a Dunzo, but in tier 2 and tier 3 cities. Khatabook can charge the users some amount of the commission obtained from sales for the logistical and technological support.